Dynamic TAO – 1 Month Review

Written by: Seth Bloomberg, Unsupervised Capital

It’s been ~1 month since the launch of Dynamic TAO. I wanted to share (1) some data I look at frequently and give some thoughts on how I interpret the numbers, and (2) give some general thoughts on how the first month has gone and where I see some opportunities.

Data Review

The high-level data I look through is usually found on either taostats.io, tao.app, or backprop.finance. Most of the charts/data here come from

ao.app, so thank you to @xavi3rlu + @latentholdings for building this.

TAO Staked to Root

This one is simple, no explanation needed.

Root stakers earn a risk-free APY on their TAO, so there is a good incentive to do this. If this number goes down, TAO could be inflowing into subnet liquidity pools (more on this below) or flowing to exchanges (likely to be sold off into fiat or other assets). If it goes up, TAO could be flowing to root from subnets, or moving from exchanges to root.

After the launch of Dynamic TAO (~Feb 13th), TAO staked to root grew and peaked at ~6.05M on Feb 24th. It’s been trending down since that date, somewhat in line with the broader market downturn, and recently on ~March 9th, it dropped from ~5.98M to ~5.93M now. Throughout this year, I expect to see TAO slowly leave root and flow into subnet pools, but as we’ll see, broadly this is not occurring yet.

Emitted TAO vs TAO Staked in Subnet Pools

This is likely the most important, high-level metric to understand and have a view on where it will trend. It tells you when TAO has entered the ecosystem, meaning (at least some) Alpha prices will have gone up. Entering Alpha markets before a large wave of TAO capital follows on is how you can generate positive ROI. Determining the right indicators for what drives the underlying data here is massively important. There’s one indicator I discuss below that will drive TAO inflows.

TAO flows into subnet pools by (1) the protocol emitting 1 TAO per block (allocation splits based on a subnet’s price) and (2) TAO holders swapping their TAO for the subnet token (calling these Alpha tokens now). Comparing the protocol emitted TAO to the total TAO staked in subnet pools indicates whether new (non-protocol emitted) TAO is entering subnet pools.

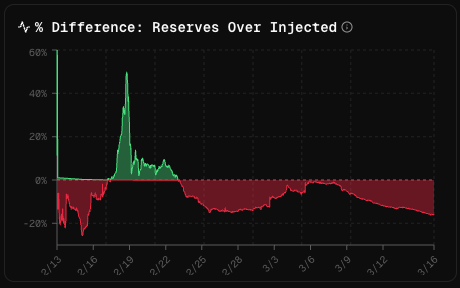

The straight, green, linear line here shows the cumulative TAO emitted every day across all subnet pools (~7200 TAO per day). Since the launch of dTAO, there have been ~225,765 TAO injected into subnet liquidity pools. The other line shows the total amount of TAO staked across all subnet pools (currently at ~189,381). The spike around Feb 19th resulted from external (non-protocol emitted) TAO flowing in subnets. This was likely early TAO holders who were excited about the recent launch of the upgrade and wanted to experiment with buying subnet tokens.

Fast forward to today, and the TAO reserves are well below the total TAO injected line (~-16%). So, on the net, more TAO is leaving subnet pools than is flowing in (both from the protocol injections and TAO holders). This also helps further back up the claim that TAO leaving root is largely not flowing into subnets (yet).

This metric (staked TAO in dTAO vs injected TAO) has been the source of pain for many dTAO traders. When TAO liquidity flows out of subnet pools, this puts downward pressure on Alpha prices. Those left holding the Alpha bag last (i.e., the last to the exit doors of the subnet pool) right now are likely down heavily. Positive ROI for these holders requires new TAO capital to enter the Alpha markets and/or hope the current TAO liquidity becomes more concentrated into their Alpha bags.

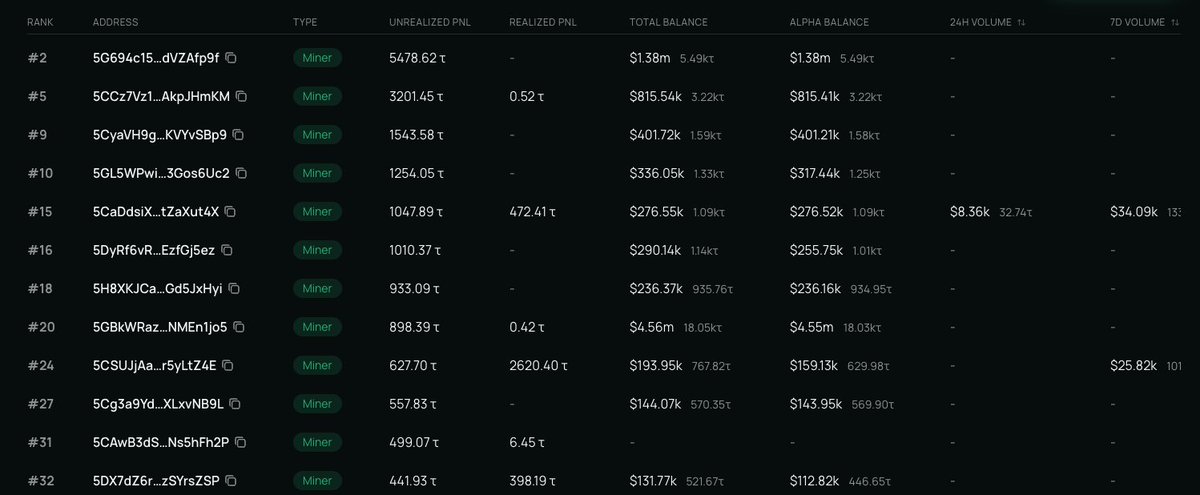

The large (negative) net difference in reserves against injected TAO is not necessarily unexpected, primarily for three reasons. First is the broader market — most assets have struggled over the past couple of weeks, TAO and Alpha tokens are obviously not immune to this. Second, miners have expenses to cover, so they have to at least sell off a portion of their Alpha.

They are, in a sense, “forced sellers” to some degree, and we can see this in the data from Backprop. Third, the protocol is “auto-selling” a chunk of Alpha for TAO and sending it to root stakers, which effectively removes this TAO from subnet pools. This is due to the protocol design (i.e., root proportion, more on this later), and this sell pressure will be reduced over time.

Alpha Volumes

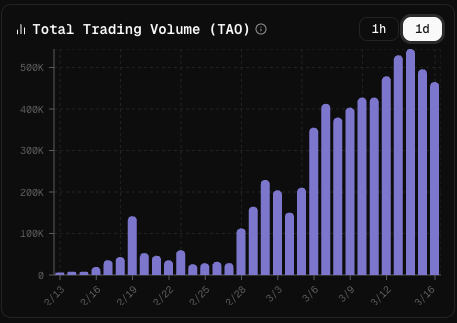

Trading volume is self-explanatory, but gives some indication of how interested the overall market is in subnet tokens.

These are the daily trading volumes (in TAO) across all subnet pools. Even with muted price action for most Alpha tokens and TAO, daily volumes are still trending up, which is a positive sign.

As Xavier from Latent Holdings

, this has resulted in over $1B of trading volume in this first month.

Emission Distribution

What does the distribution of TAO emissions look like?

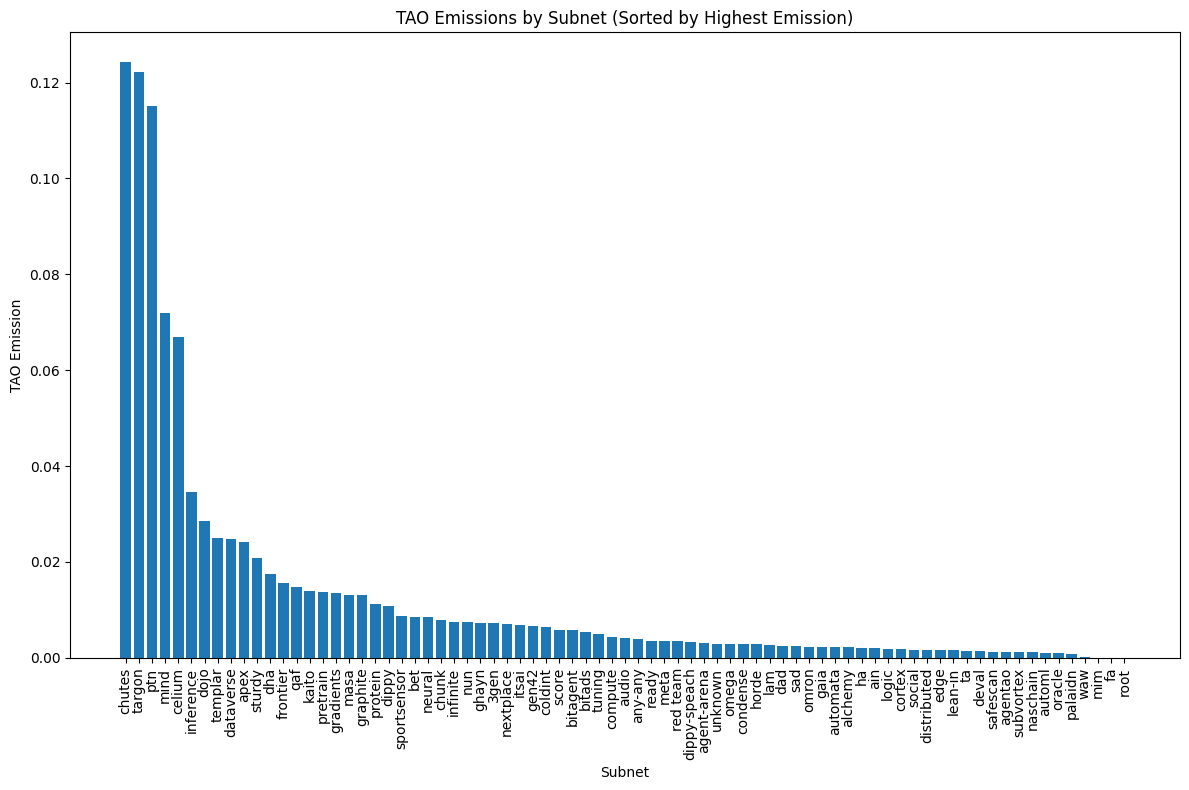

Here all the subnets with their associated TAO emissions, sorted by the highest emission. The top 5 subnets account for ~50% of all the emissions, and the general shape of this curve is power law-ish.

I expect this chart to change over time. First, I expect holders of some of these “top” subnets to realize some gains and rotate them into some of the longer tail subnets that are flying under the radar. If you can identify these subnets, this is how you can enter Alpha markets before larger TAO inflows. Second, new subnets will continue to register onto the network, some of these will be investable and will make their way up this chart.

There’s a lot more to be said here, but for now, we’ll leave it there.

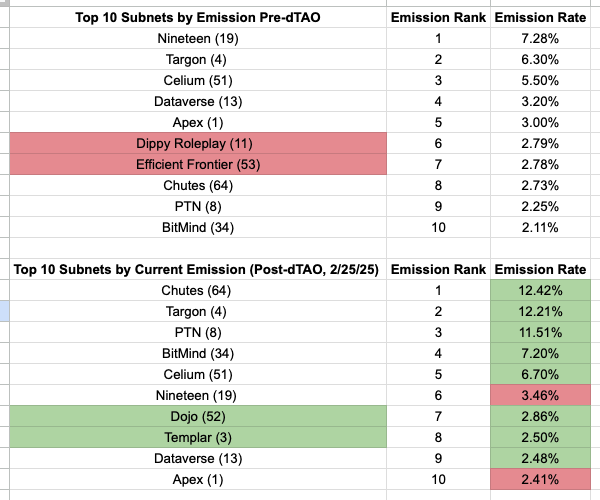

Top 10 Subnets by Emissions Pre-dTAO vs Current Top 10

Self-explanatory, and I’ve looked at this data a few times already. But let’s see how it compares now.

As has been the trend, not much shuffling has taken place within the top 10 subnets by emission. The emission distribution is wider now, but largely it’s the same players. Again, it will be interesting to see how/if this changes over time with new subnets emerging and existing subnets continuing to develop their products/services.

Root Proportion

The root proportion is the percentage of validator rewards that flow to root stakers rather than Alpha stakers. Over time, this value will decrease and the Alpha staker proportion will increase proportionally. Functionally, this means root stakers will see their APYs drop, which may lead some to allocate more of their TAO holdings into subnet pools. This is likely one of those indicators that will push external TAO inflows into Alpha markets.

Right now, most existing subnets are likely somewhere around ~75% root proportion, with newer subnets closer to 100%. So, with ~75% root proportion, we can read this as “of the 41% validator emission allocation, ~75% of that Alpha is auto-sold into TAO and sent to root stakers”. This is an incentive to slowly move root stakers off of root and into subnet pools, under the assumption that these TAO stakers are APY-sensitive and will start this migration process in tandem with a reduced root APY. Clearly, this is not the case yet as we have seen in the Emitted TAO vs TAO Staked in Subnet Pools data, but I do assume that TAO stakers are APY-sensitive, and we’ll eventually see flows coming from the root network.

General Thoughts and Notes

These thoughts and notes are more stream-of-consciousness style. I’d love feedback on anything I’m missing.

Swordscan – Mindshare Tool

Knowing what has the attention of the market is critical, so it’s great to see the

Mindshare tool emerge within the ecosystem. It lets you see top movers and do relative comparisons across subnets. Check it out if you haven’t already and read

‘s

too.

The Good/Bad of Subnet Launches

We’ve seen the subnet count grow from 64 to 78 in just a month of Dynamic TAO. Since a significant amount of TAO is used to register these subnets, there is clearly demand to join the network. For reference, the last 7 subnets have spent a combined ~1,825 TAO (~$450K USD) to register onto the network.

One looming point of friction with many new subnet launches is their TAO emissions. Again, TAO emissions are largely a function of a subnet’s price. Some new subnets have launched without public documentation, Twitter accounts, GitHub links, etc. This makes it difficult for the market to assess the value of the subnet, but, since the liquidity is extremely thin, it’s relatively easy to maintain a high price in the short term. TAO emissions are zero-sum, so the point of friction is that these subnets (which are largely unknown/have little-to-no public docs) can fairly easily acquire emissions that would otherwise be going to the rest of the network. There’s work being done here though, so I expect to see some changes rolling out for this.

On the other hand, more “publicly” launched subnets, such as Nova (SN68) and Safe Scan (SN76) seemed to be generally well-accepted by the broader community/market. Nova in particular is doing well from an emissions perspective, currently holding the 12th place with 1.75% emissions.

Transaction Supply Chain and Apps/Businesses

I will admit, I’m still learning the full “transaction supply chain” on Bittensor. It’s different than the EVM and Solana pipelines I’m familiar with. And since Bittensor has historically not been a “general-purpose” chain like other smart contract platforms, the transaction supply chain has not been very relevant. But, now there is trading activity and more (upcoming) smart contract activity, I see understanding the transaction supply chain as growing in importance.

To that end, there have been more bots buying/selling tokens, and some have pointed out certain bots can reliably place their transactions within a block, which most did not think was possible. In general, the transaction supply chain is something I plan to dive into further, along with its other business opportunities (wallets, trading bots, RPC providers, MEV tooling, etc).

These types of applications/businesses are some of the top revenue producers in other ecosystems, so these will likely be large opportunities here within Bittensor as well.

DeFi and EVM/Smart Contracts

The EVM is slowly but surely taking off. Below are just some of the launches/activity I’m seeing.

DeFi

Two teams building out DeFi protocols are TaoFi and Backprop. The TaoFi protocol is being built out by the Sturdy Finance team and the Subnet 10 team. Backprop is being developed by Tensorplex, which also has a subnet and other DeFi-related products for Bittensor. Both are still in the early stages of building, but given they are backed by great teams, I’m excited to see what these teams develop.

General Apps

Similar to the ENS protocol on Ethereum, a TAO Naming Service (TNS) has popped up. As a caveat, I haven’t done a super deep dive on this so use it at your own risk, but it looks like you can grab a .tao name for your wallet.

The other interesting launch is Taofu. The high-level description is that it allows subnet owners to “tokenize” their future emissions, which could potentially give them liquidity without directly selling through their own subnet liquidity pools. They’re also still early in development, so issues may arise with their model, but in general, I’m interested to see how the community reacts to this.

Alright, that’s the brief ~1 month review of Dynamic TAO. Would love to chat if you’re reading this and have questions/want to tell me where I’m wrong/share other thoughts.