A Framework for Classifying Bittensor Subnets

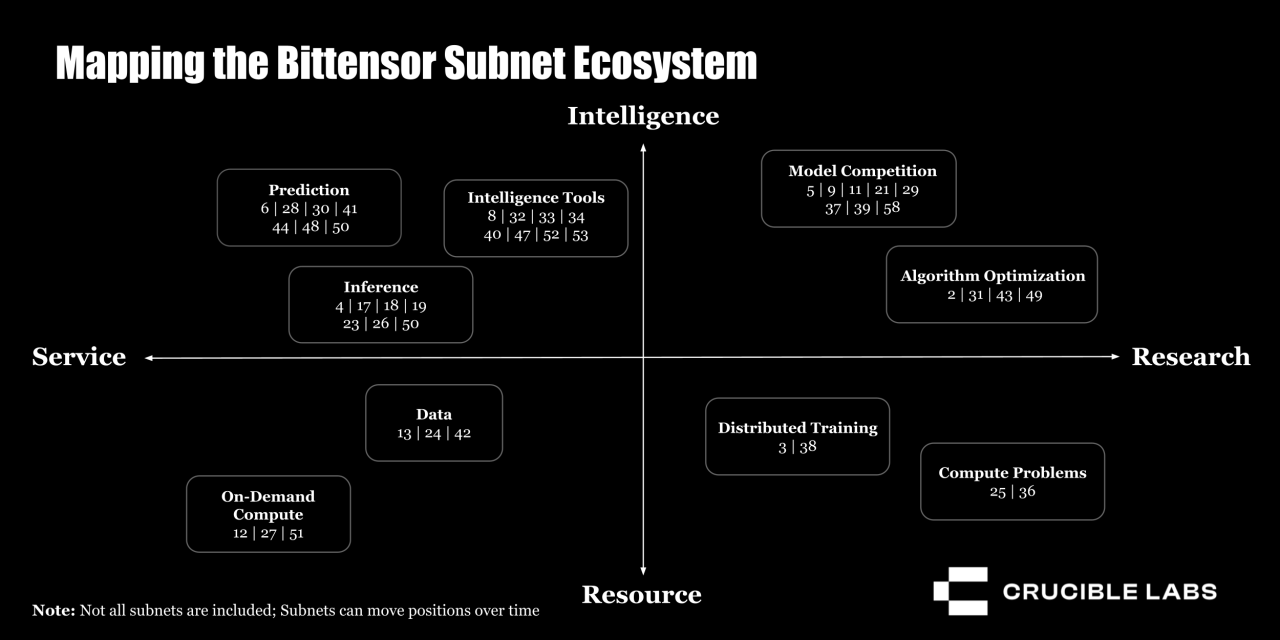

We’ve observed a fascinating diversity across Bittensor’s subnet ecosystem. Some subnets are purely focused on research efforts in specific fields like biochemistry and model training, while others provide immediate utility by solving market needs. These subnets also vary in what they’re coordinating – some incentivize specialized knowledge and expertise, while others incentivize providing standardized digital resources.

Through analyzing these patterns, we’ve developed a framework to evaluate subnets along two key axes: one that defines their overarching objective and another that captures what is being coordinated.

- The Objective Axis – Research-oriented to Service-oriented

- The Coordination Axis – Intelligence-focused to Resource-focused

The Objective Axis

The Objective Axis spans from pure research to service delivery. Service-oriented subnets produce outputs with immediate market value, typically providing backend infrastructure that can be integrated directly into products and applications. If the service finds product-market fit, validators within the subnet can monetize their bandwidth (access to miners based on their stake). This monetization capability creates structural demand for TAO, or post-dTAO upgrade, the subnet’s token. Traditional valuation frameworks, such as those analyzing market sizing and cash flows, could be useful for evaluating service-oriented subnets and their eventual tokens.

On the opposite end of the spectrum, research-focused subnets are dedicated to pursuing breakthroughs without a clear path to immediate monetization. Similar to how early AI labs focused on solving foundational problems before finding product-market fit through applications like chatbots. These subnets are more akin to pre-revenue deep tech startups – their value isn’t derived from current validator bandwidth monetization but from the potential magnitude of future breakthroughs. When buying the subnet token, investors would be making conviction bets on these teams, believing they will solve fundamental research challenges and, eventually, transition the subnet into a revenue generating venture to monetize their breakthroughs.

The Coordination Axis

The Coordination Axis offers one of the most important insights about subnets: whether their value comes from coordinating intelligence or coordinating resources. Intelligence-focused subnets harness collective brainpower – they coordinate researchers, engineers, and domain experts to solve open problems. For miners, the barrier to entry isn’t capital but knowledge. These subnets thrive on the specialized expertise of their participants, and success depends on the ability to bring together the right minds to collaborate on innovative solutions. The value of these subnets is driven by the potential to solve novel problems, rather than simply executing known solutions.

Resource-focused subnets coordinate standardized resources like compute, storage, and bandwidth for specific purposes – whether creating a marketplace for cloud compute or directing resources toward scientific tasks like protein folding. These subnets naturally face a more daunting challenge as they compete with established players through resource coordination. Take cloud compute: AWS has spent decades and billions optimizing its infrastructure. They can operate at razor-thin margins or even treat services as cost centers, making it nearly impossible for decentralized alternatives to compete purely on cost and reliability.

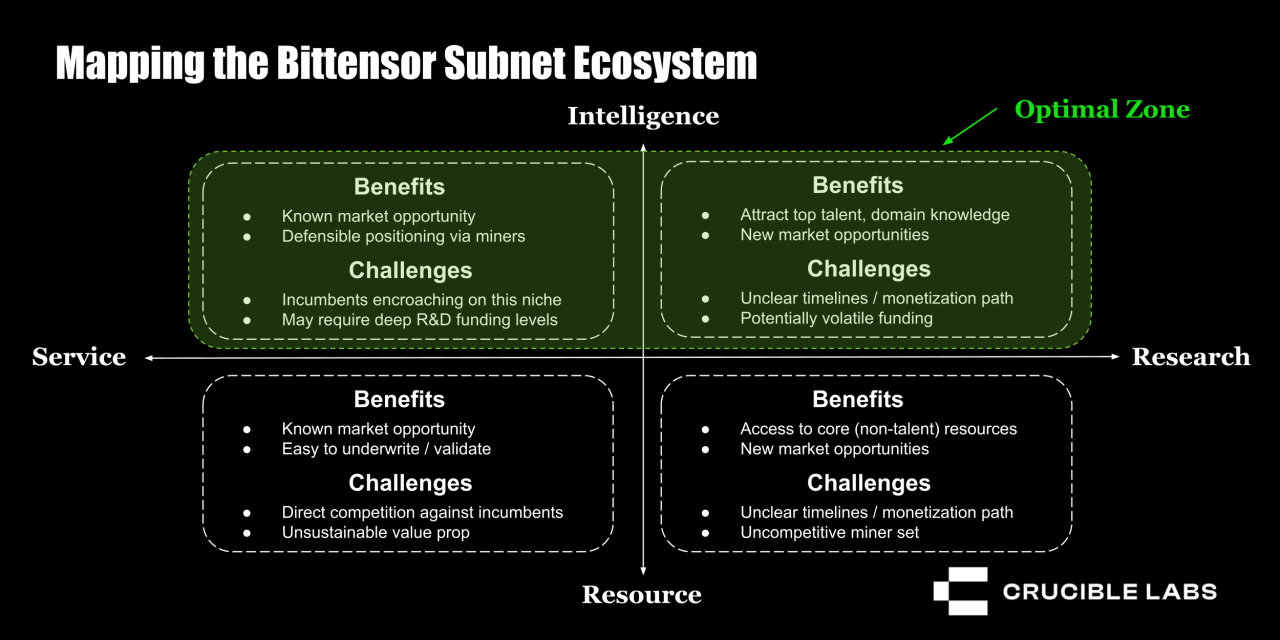

Competitive Dynamics

Bittensor, as a holistic platform, needs both service and research-oriented subnets. Service-oriented subnets demonstrate immediate utility, powering real applications and products that meet current market demands. Research-focused subnets attract top talent and drive innovation, creating speculative value through potential breakthroughs. This balance allows Bittensor to capture both structural and speculative demand – both crucial for sustainable token value appreciation.

The parallel to big tech is instructive: just as companies like Google maintain both R&D divisions (DeepMind) and productization units (Google Cloud), Bittensor needs this vertical integration at an ecosystem level.

Looking at the Coordination Axis, we believe new subnet developers might find more opportunities in coordinating intelligence rather than resources. Resource-focused subnets face an uphill battle competing with incumbents on standardized services, where economies of scale dominate the competitive landscape. We’ve seen this challenge play out in DePIN, where even significant cost advantages haven’t been enough to overcome the switching costs and reliability concerns when competing against established players.

Intelligence-focused subnets offer a more promising path. They can build defensible positions through innovation and specialized knowledge, areas where even tech giants don’t have insurmountable advantages. This is particularly true in emerging fields where the game isn’t yet won.

Where Builders Should Build

Based on our framework, we recommend builders focus on the top two quadrants.

For Bittensor to achieve long-term sustainability, subnet developers should incentivize miners to produce differentiated services that validators can commercialize, rather than focusing primarily on raw resource provision where established players already dominate. While resource-focused networks have their place, we believe better opportunities lie elsewhere.

Subnets that successfully combine a research angle with a service they can deliver, while focusing on coordinating intelligence, present the highest potential for sustainable and defensible value creation